Trusted by businesses worldwide

5/5

5/5

5/5

AI Blog Post Software With 100% Automation

Automate content planning, writing, and publishing, so you can focus on what matters most to your business.

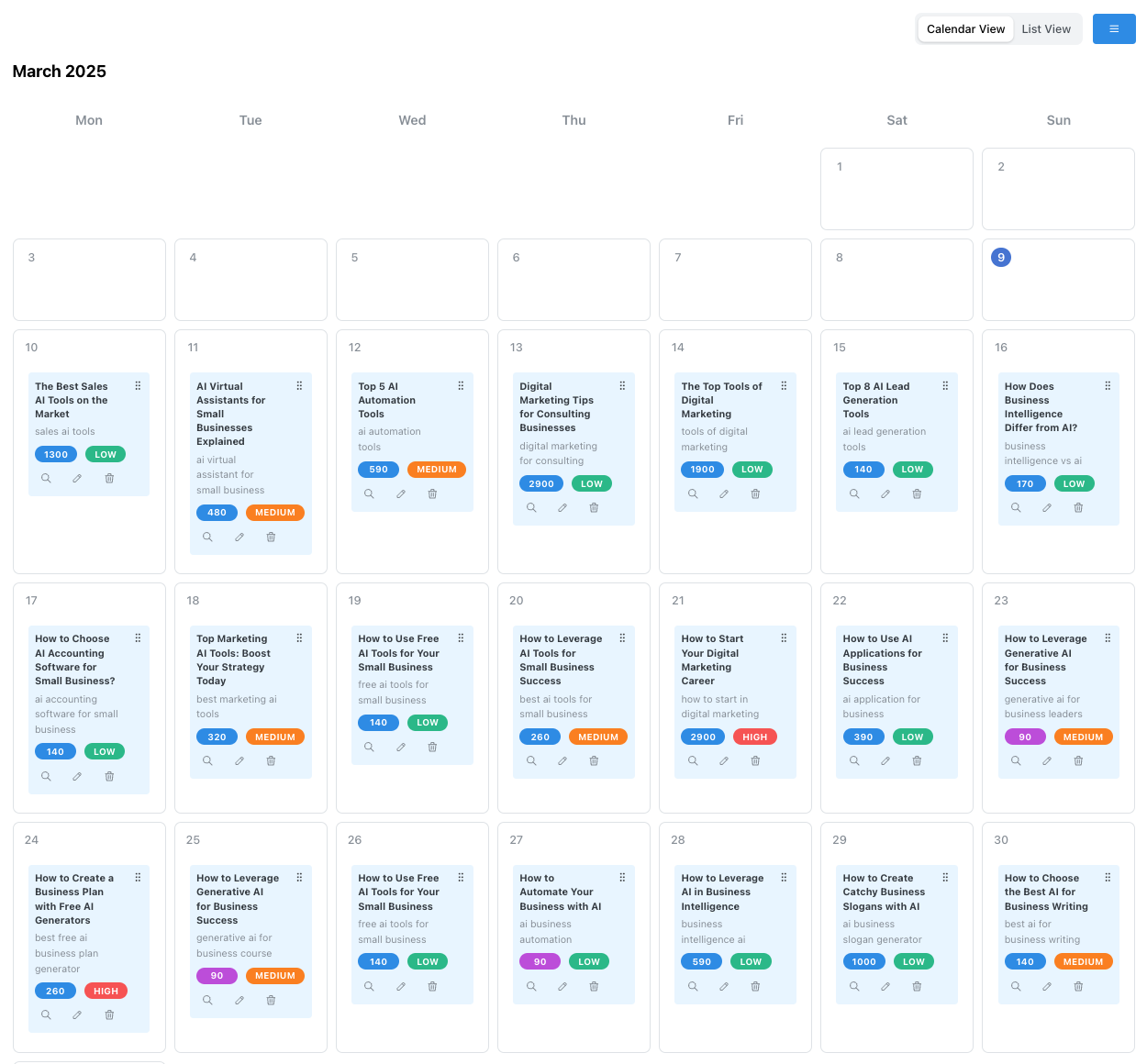

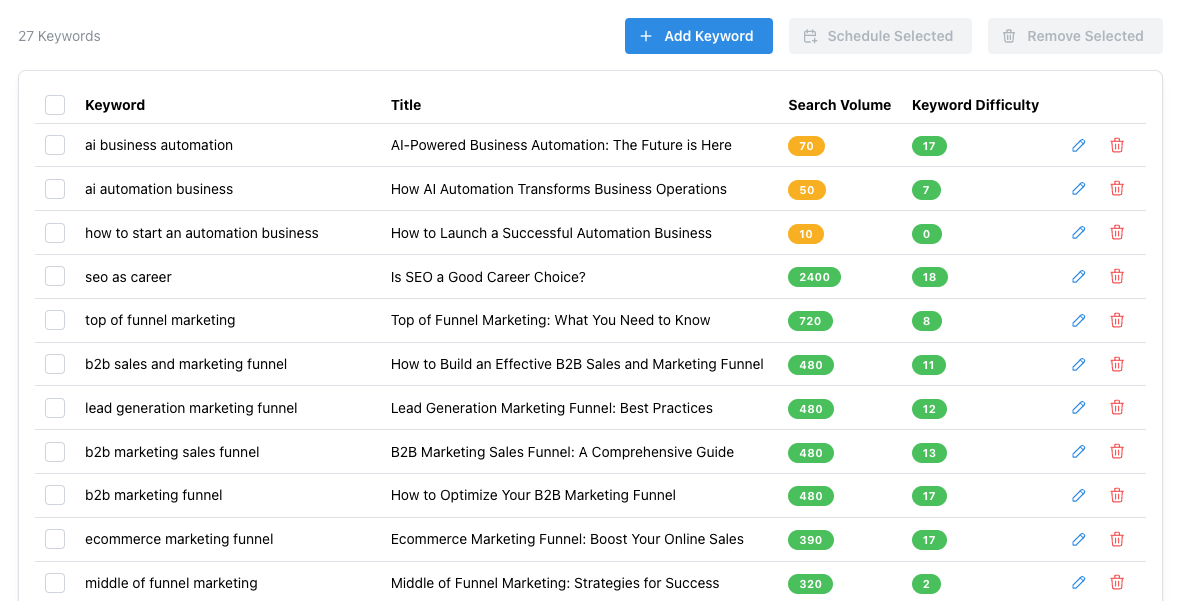

Receive a complete content plan

Our AI analyzes your business and audience to research keywords and create an optimized content calendar.

Let our AI handle the research and writing

High-quality, SEO-optimized content is automatically generated based on the content plan.

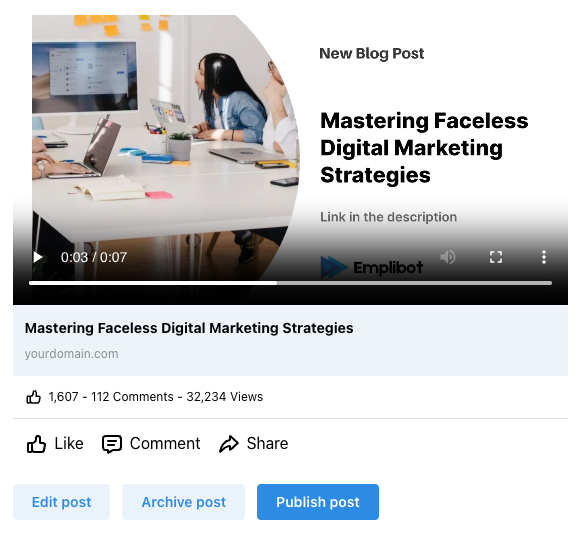

Auto-publish to your channels

Connect your website and social media accounts and auto-publish your content at optimal times.

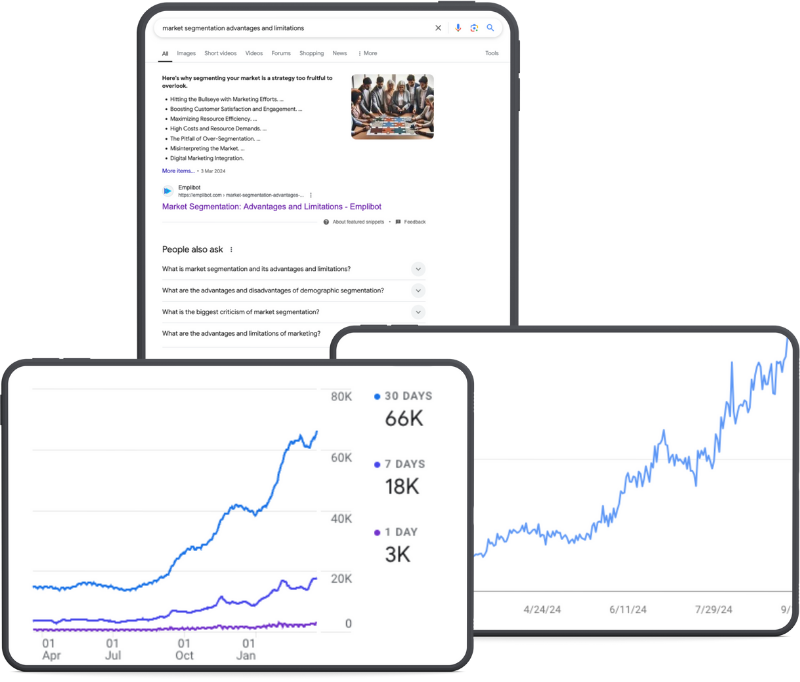

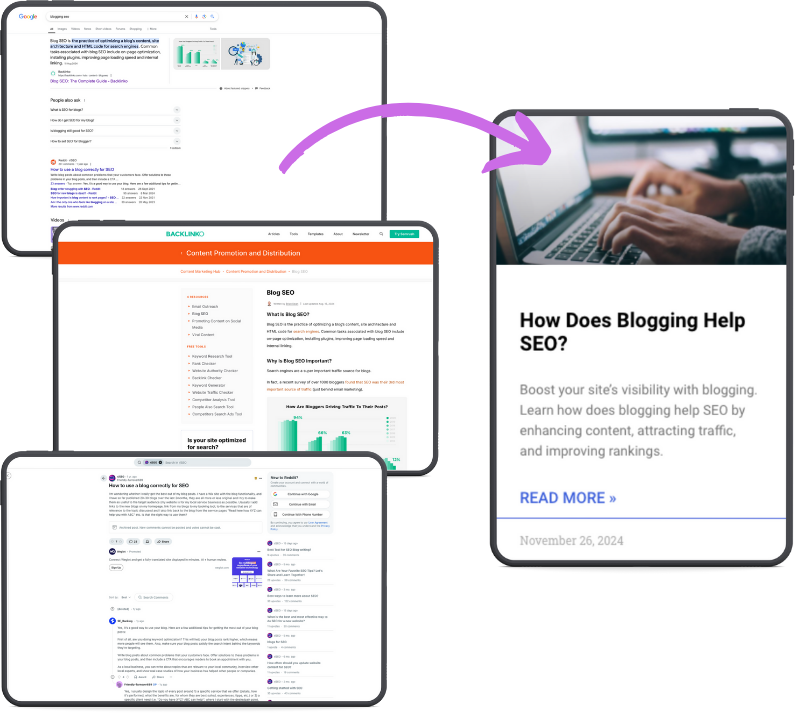

AI Article Writer That Drives Real Results

Take advantage of high-quality AI content from our blog creator that drives traffic and builds trust with your audience.

Researched & Fact-Checked

Experience an AI that mimics the workflow of human writers. Before an article is generated, Emplibot's AI reviews hundreds of websites to create trusted content.

Publish extensively researched content

Save hours of research time with an AI that automatically gathers information from trusted sources.

Leverage AI fact-checking

Publish content that is verified against, and referencing trusted sources.

Build trust with your audience

Build credibility with your audience by providing accurate and reliable information.

Frequently Asked Questions

Experience The Power Of AI Content Marketing

Start growing your business today. Save countless hours of tedious work.

7-day free trial

Cancel anytime